Georgia 529 Contribution Limits 2025

Georgia 529 Contribution Limits 2025 - In 2025, you can contribute up to $18,000 per beneficiary per year before. North dakota is the next lowest, with a maximum of $269,000. 2025 529 Contribution Limits What You Should Know MyBikeScan, In 2025, you can contribute up to $18,000 per beneficiary per year before. “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into.

In 2025, you can contribute up to $18,000 per beneficiary per year before. North dakota is the next lowest, with a maximum of $269,000.

Plan Your 2025 Retirement Contributions Velisa Bookkeeping Services LLC, In 2025, you can contribute up to $18,000 per beneficiary per year before. Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

529 Plan Contribution Limits For 2025 And 2025, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary. Of course, there are some basic rules you must abide by before you can do this.

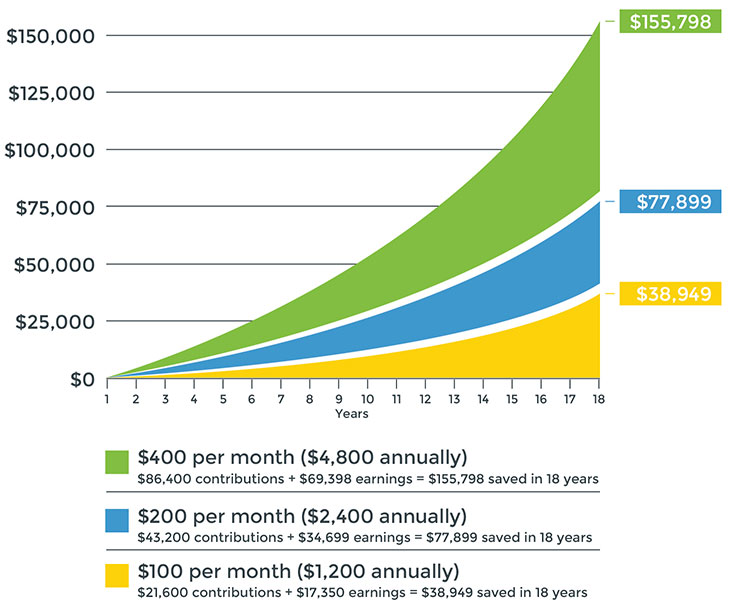

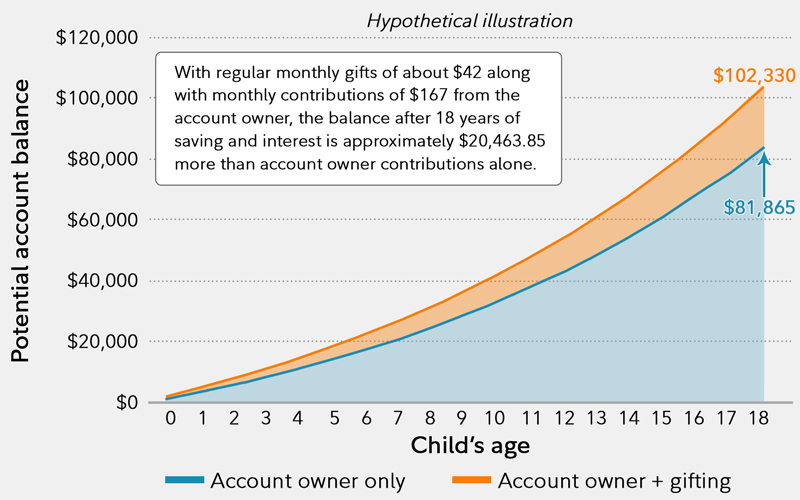

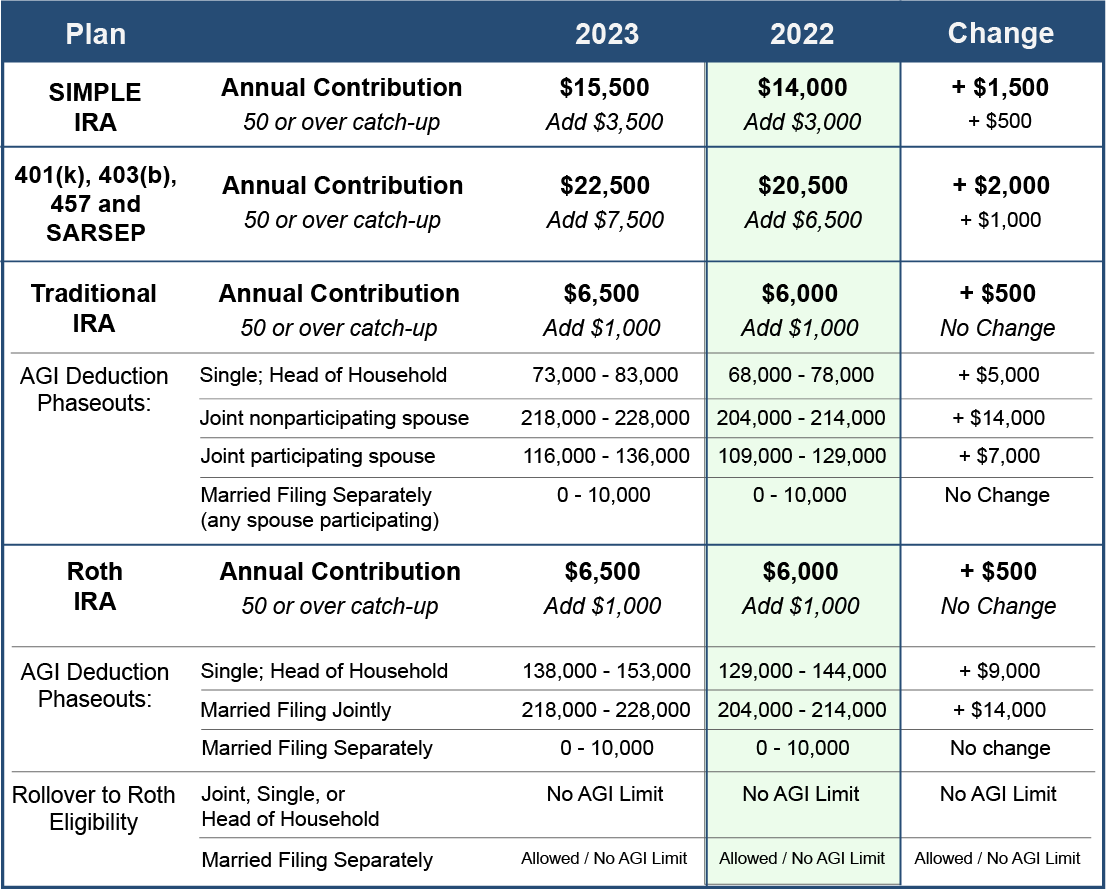

529 contribution The gift of education Fidelity, However, some people will have to. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

North dakota is the next lowest, with a maximum of $269,000.

2025 529 Contribution Limits Your Complete Guide to Maximum, However, some people will have to. For example, missouri allows families to contribute up to $550,000 into a 529, while georgia has a maximum of just $235,000.

529infographic IonTuition Education Fintech Services, “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into. Georgia 529 contribution limits 2025.

Max 529 Contribution Limits for 2025 What You Should Contribute, Unlike retirement accounts, the irs does not. Georgia offers a state tax deduction for contributions to a 529 plan of up to $4,000 for single filers and $8,000 for married filing jointly tax filers.

529 Plan Contributions NEST 529 College Savings, 8 to be eligible, though, you must have. For contributions made to a path2college 529 plan account by april 18, 2025, georgia taxpayers may be eligible for a state income tax deduction up to $8,000.

Contributions up to $4,000 per year, per beneficiary, are eligible for a georgia state income tax deduction for those filing a single return;

For example, missouri allows families to contribute up to $550,000 into a 529, while georgia has a maximum of just $235,000.

529 Plan Contribution Limits Rise In 2025 YouTube, New in 2025, you can now roll assets from a 529 account into a beneficiary's roth ira, up to a lifetime limit of $35,000. In 2025, you can contribute up to $18,000 per beneficiary per year before.

Georgia 529 Contribution Limits 2025. There are no yearly limits to how much you can contribute to a 529 plan. Instead, the amount you can contribute is maxed out at a total contribution for a single.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, However, some people will have to. 8 to be eligible, though, you must have.