Roth Ira Income Limit 2025

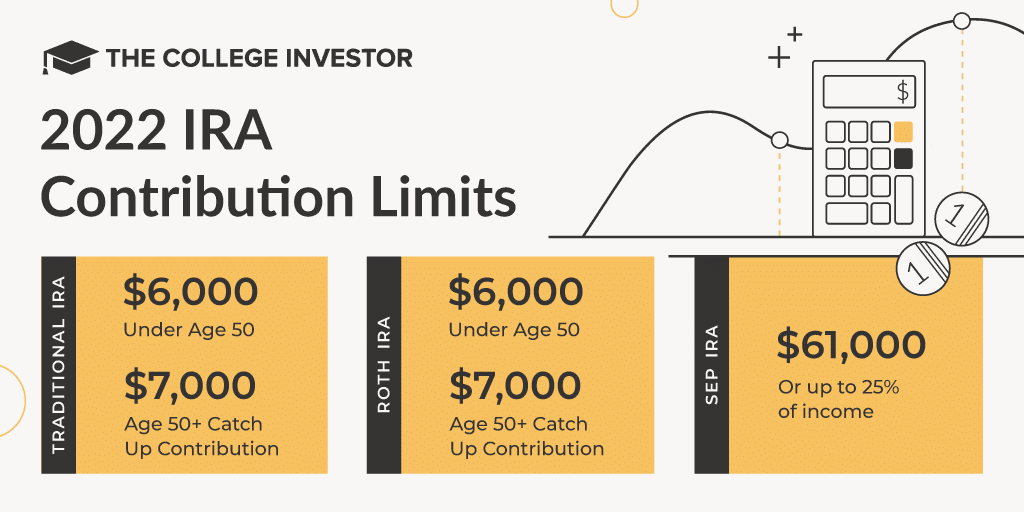

Roth Ira Income Limit 2025 - Ira Limits 2025 For Deduction Definition Fleur Jessika, The limit for contributions to traditional and roth iras for 2025 is $7,000, plus an additional $1,000 if the taxpayer is age 50 or older. 2025 Roth Ira Limits Aura Margie, Roth ira income limits and contribution limits 2025 the 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

Ira Limits 2025 For Deduction Definition Fleur Jessika, The limit for contributions to traditional and roth iras for 2025 is $7,000, plus an additional $1,000 if the taxpayer is age 50 or older.

Roth Ira Income Limit 2025. The irs sets contribution limits for all iras, including roth accounts. Key takeaways the roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

Max Roth Contribution 2025 Over 50 Jemie Hermione, In 2025, these limits are $7,000, or $8,000 if you're 50 or older.

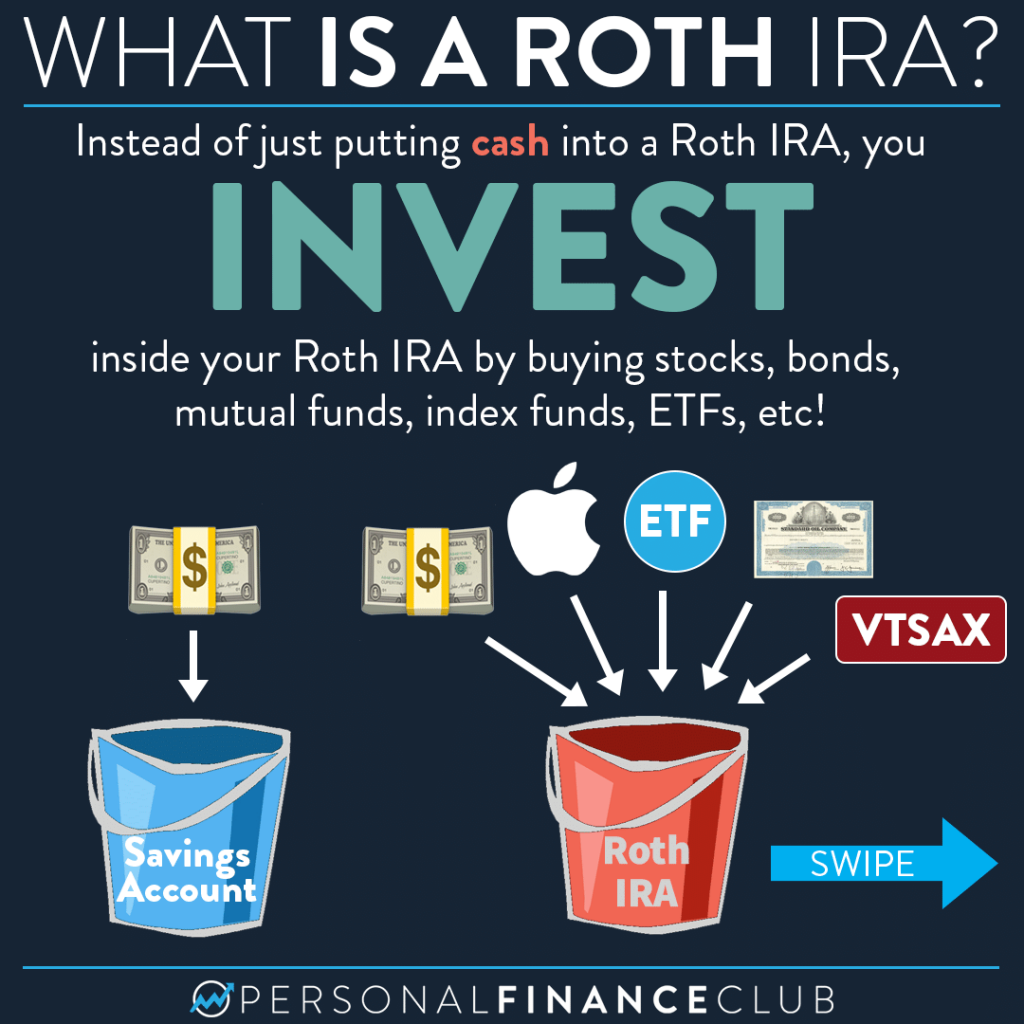

Roth Ira Limits 2025 Limits Gusty Katusha, A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira.

2022 Ira Contribution Limits Over 50 EE2022, Roth ira income and contribution limits for 2025.

Roth Limits For 2025 Jayme Iolande, The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older.

Roth Ira Limits 2025 Salary Flossy Marcelia, Read the article for more information.

2025 Roth Ira Limits Phase Out Minda Fayette, Roth ira income limits and contribution limits 2025 the 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

Roth Ira Limits 2025 Joint Lia Tandie, Amount of your reduced roth ira contribution if the amount you can contribute must be reduced, figure your reduced contribution limit as follows.

Individual Roth Ira Limits 2025 Deny Stephine, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Contributing to a roth ira is a great way to save for retirement, but there’s an annual contribution limit. Read the article for more information.