Tax Brackets 2025 Married Filing Separately

Tax Brackets 2025 Married Filing Separately - At&T Stock Forecast 2025. This indicates an +5.80% rise from… 2025 Health Observances Calendar. Health awareness months aim to raise…

At&T Stock Forecast 2025. This indicates an +5.80% rise from…

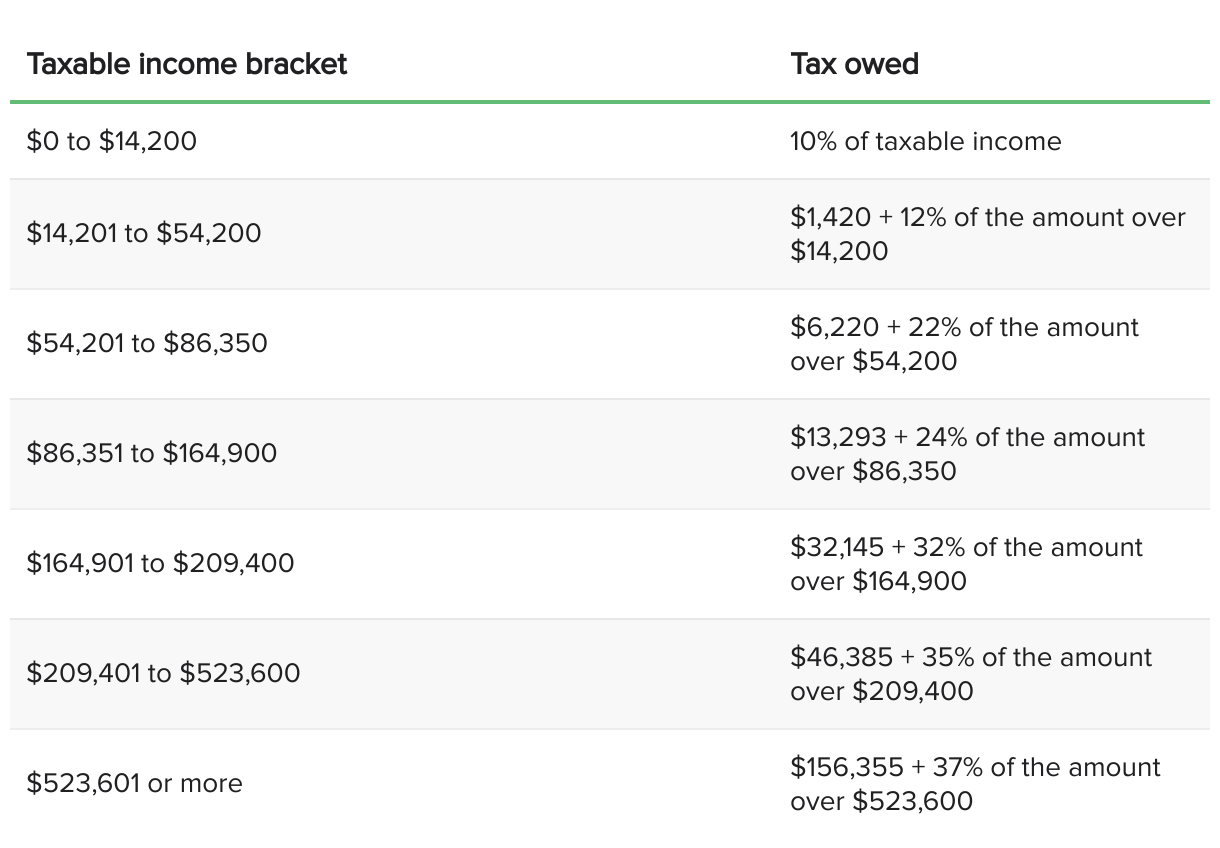

Tax Brackets Definition, Types, How They Work, 2025 Rates, Taxpayers whose net investment income exceeds the irs limit ($200,000 for an individual taxpayer, $250,000 married filing jointly, or $125,000 married filing. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

Hangout 2025 Lineup. Lana del rey, zach bryan & odesza…

Filing a joint tax return means your income and your spouse’s income get combined together. What is the married filing separately income tax filing type?

2025 Tax Brackets Announced What’s Different?, Married medicare beneficiaries that file separately pay a steeper surcharge because. The joint income is subject to different tax brackets than single filers.

2025 Tax Brackets Married Filing Separately Synonym Wylma Rachael, To figure out your tax bracket, first look at the rates for the filing status you plan to use: When you choose this status, each spouse files their own tax return, reporting.

Tax Brackets 2025 Married Separately Elle Willetta, You pay tax as a percentage of your income in layers called tax brackets. 2025 tax brackets married filing separately married.

2025 Tax Brackets Married Filing Separately Married Filing Adele Antonie, You pay tax as a percentage of your income in layers called tax brackets. Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

Understanding Tax Tables Federal Tax Brackets for Married Filing, The bracket you’re in depends on your filing status: Single, married filing jointly, married filing separately, or head of household.

2025 Tax Brackets Married Filing Separately Married Bria Marlyn, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. For the 2025 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for.

The joint income is subject to different tax brackets than single filers.

What are the Different IRS Tax Brackets? Check City, When you choose this status, each spouse files their own tax return, reporting. Federal — married filing separately tax brackets.

Tax Brackets 2025 Married Filing Separately. The 2025 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025. For the 2025 tax year, the standard deduction for married couples filing jointly is.

Taxpayers whose net investment income exceeds the irs limit ($200,000 for an individual taxpayer, $250,000 married filing jointly, or $125,000 married filing.

2025 Tax Brackets Married Filing Separately 2025 Klara Michell, When deciding how to file your federal income tax return as a married couple, you have two filing status options: The 2025 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, When you choose this status, each spouse files their own tax return, reporting. There are seven tax brackets for most ordinary income for the 2025 tax year: